Esusu acquires Celeri to revolutionize fraud prevention in housing 🔑 Read more →

Introducing myEsusu

The new, easier way to build credit

Is your credit score holding you back? myEsusu is a credit-building membership to help turn your financial dreams into reality. Built for those who’ve been overlooked, designed to help you thrive.

Let’s unlock tomorrow, together.

From rent to credit in no time

Tell us about yourself

Let us know who you are and share your lease info.

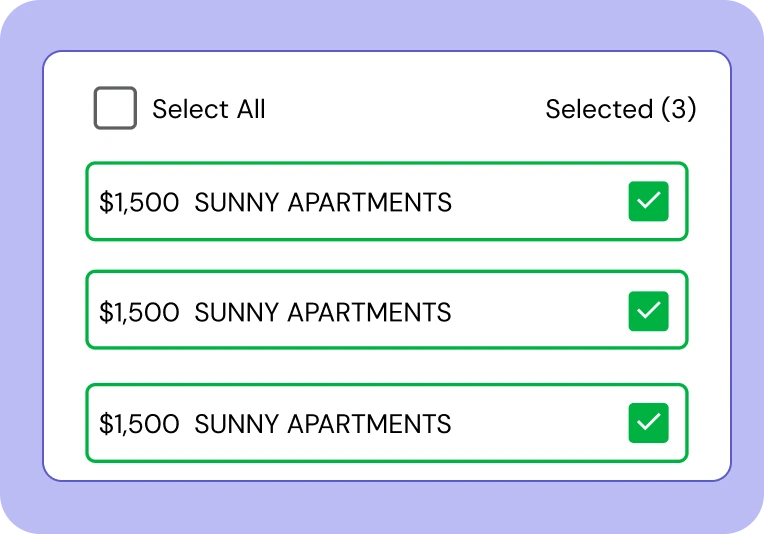

Report your rent payments

Link your bank account and choose your rent payments from the past 24 months.

See your credit score grow

Report to all 3 major credit bureaus and watch your credit score grow.

Why myEsusu?

We make it easy…

- No hard pulls

- No hidden fees

- Secure bank account linking & checkout

- Included 24 month rental history

- All credit scores welcome

To get the credit you deserve.

- Average Esusu users see +46 points to credit

- Better rates = interest with better credit

- Savings on everyday purchases

- Understand the credit system

- Financial progress for the long term

We’ve got your back at each step of your financial journey

Rent Reporting

Get credit for paying

your rent on time.

Esusu

Marketplace

Explore hand-picked credit building, auto, tax, and rental products

and services from select partners.

Credit Building

Check your credit score

for free, see your

score factors, and get tips.

Esusu Toolkit

Access free financial resources

and support.

Join millions of renters with access to Esusu

5,000,000+

An experience renters and

property managers love

Renter

Daphne H.

“I have been using Esusu for under a year. My experience with building credit and financial stability before Esusu was non existent because I didn’t have financial discipline. Esusu has had such a positive financial impact on my life with its extensive support system to help you on your financial journey. Building credit and financial stability is important to a healthy credit portfolio.”

Aug 11, 2023

Renter

Eugene H.

“I began my journey with Esusu in April 2023 for rent relief program at my current housing complex, which was truly a God-send. Since then, my credit stability has improved tremendously with each on-time monthly payment and has increased my credit score and afforded me other opportunities to continue growing.”

July 5, 2023

Renter

Letique M

“Esusu has helped my score go up by reporting my own time payments. Before the credit building help, I could not get approved for anything and suffered from a low score. So far, my journey has become brighter, I know how to build my scores and help my future. It is important to me to be financially and credit literate because I hope to own a house, car, or estates in the future. Without this knowledge, none of it is possible.”

Sep 10, 2023

Membership benefits

$0

Free

Toolkit

Marketplace

Financial tools

BEST VALUE

$2.50

/month

Core

Toolkit

Marketplace

Credit Score Hub

Financial tools

Credit Score Factors

Positive Rent Reporting

$54

/month

Premium

Advanced tools to take your work to the next level.

Multi-step Zaps

Unlimited Premium Apps

50 Users team

Shared Workspace